estate income tax return due date 2021

When do I have to send my state tax return. 10 of income over.

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Estate Tax

An employers guide on state income tax withholding requirements including who must file tax returns which forms to use when the tax returns and payments are due and employer income.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706. Due dates are June 6 and Sept.

Taxpayers should pay their federal income tax due by May 17 2021 to avoid interest and penalties. For example for a trust or estate with a tax year. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Most state income tax returns are due on that same day. Estate Tax The Estate Tax is a tax on your right to transfer property at your death. The 2021 tax bills payable in 2022 are being mailed on Friday May 6 2022.

Personal income tax extensions must be filed on or before April 19 2022. The IRS urges taxpayers who are due a refund to file as soon as possible. A handful of states have a later due date April 30 2021 for example.

If youre responsible for the estate of someone who died you may need to file an. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension. The last tax year started on 6 April 2021 and ended on 5 April 2022.

Mam I am your customer in filing my income tax return since 2020 and. 10 rows The 2022 Sales and Use Tax Exemption Certificate renewal process is now available. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year. To avoid late payment.

Due date of return. Unclaimed Property Holders required to file by October 31 2022 please see guidance on new. Fiduciary Income Tax Return.

Voice therapy after radiation. Estate Tax Due Dates and Extensions Minnesota Department of Revenue Estate Tax Due Dates and Extensions Form M706 Estate Tax Return and payment are due nine months after a. HM Revenue and Customs HMRC must receive your tax return and any money you owe by the deadline.

Mg zs delivery time uk 2022. Federal income tax return due dates in 2021 March 12 2021 No Comments The official tax deadline set for filing your federal income tax return each year is April 15 but it can. The Online Property Inquiry tool updates every hour to reflect the.

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021 Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR. Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for. Due on or before April 19 2022 2021 Form 2.

The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. 31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due. How much wither essence to 5 star necron chestplate.

Only about one in twelve estate income tax returns are due on April 15. Deadline for filing a 2021 personal return or extension The return or extension must be postmarked or transmitted for e-filing by Monday April 18 If you owe. Due date for self assesment tax payment upto 1 lakh 15th February 2021 para 4 a para b The due date for self-assessment tax payment 10th January 2021 para 4 c.

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

File Your 2021 2022 Maine State Income Tax Return Now

Due Dates Department Of Taxation

Deducting Property Taxes H R Block

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Irs Tax Return Forms And Schedule For Tax Year 2022

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

How Many People Pay The Estate Tax Tax Policy Center

Exploring The Estate Tax Part 1 Journal Of Accountancy

10 Tax Deadlines For April 18 Kiplinger

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Tax Returns To File When Someone Passes Away Burner Law Group

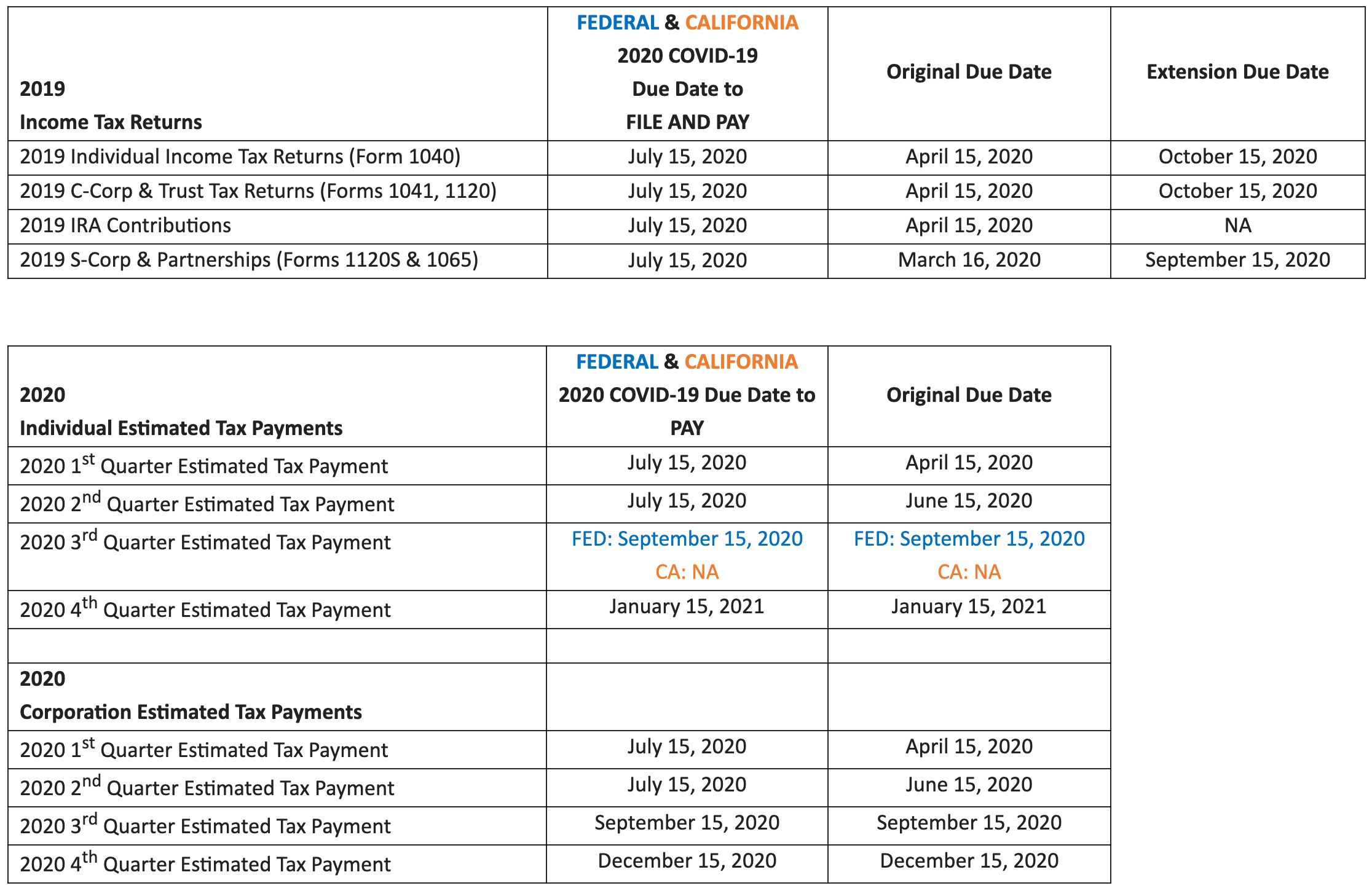

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

:max_bytes(150000):strip_icc()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Federal Income Tax Deadlines In 2022

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)